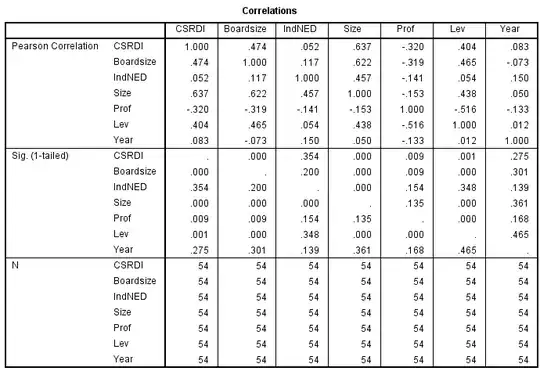

I have a situation where IVs positively correlate with the DV, and the IVs also correlate with eachother.

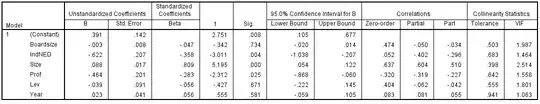

I do not explain how the beta weights are negative. No multicollinearity is detected, and the model is justified, and has an r-squared value of 5. Note for example, issue with Lev and Size; both correlate do DV CSRDI, both correlate to eachother, but negative beta for LEV and low significance?

This question specifically is asking about sign reversal. I am confused with this due to the lack of a multicollinarity issue. Lev and Size are correlated but not excessively, so why do IVs such as lev have a sign reversal in the regression model? Also is this classified as suppression? I am in no way a statistics expert and am only interested in understanding this for an assignment for my undergrad degree. So if possible, could you please explain in laymans terms. Thanks you

I was wondering if you anyone can explain this, and perhaps help with interpretation