I have first provided what I now believe is a sub-optimal answer; therefore I edited my answer to start with a better suggestion.

Using vine method

In this thread: How to efficiently generate random positive-semidefinite correlation matrices? -- I described and provided the code for two efficient algorithms of generating random correlation matrices. Both come from a paper by Lewandowski, Kurowicka, and Joe (2009).

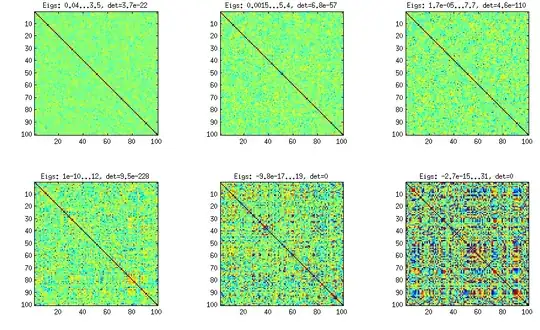

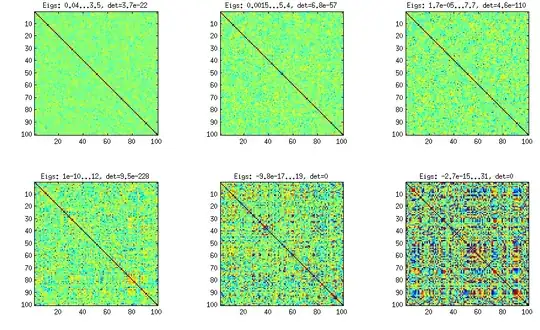

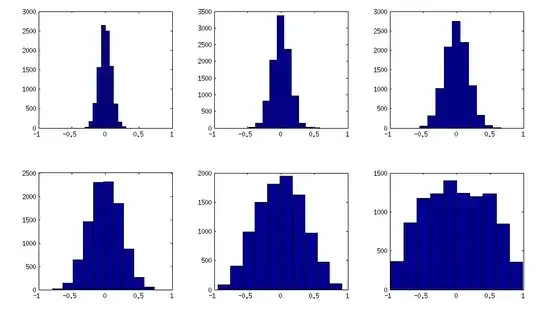

Please see my answer there for a lot of figures and matlab code. Here I would only like to say that the vine method allows to generate random correlation matrices with any distribution of partial correlations (note the word "partial") and can be used to generate correlation matrices with large off-diagonal values. Here is the relevant figure from that thread:

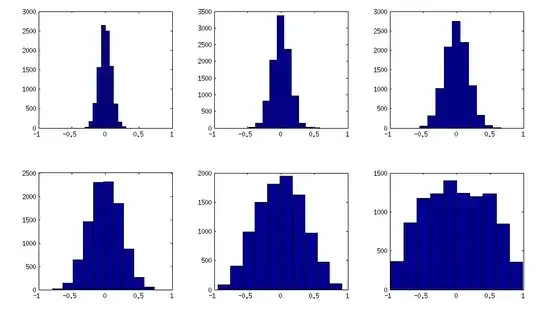

The only thing that changes between subplots, is one parameter that controls how much the distribution of partial correlations is concentrated around $\pm 1$. As OP was asking for an approximately normal distribution off-diagonal, here is the plot with histograms of the off-diagonal elements (for the same matrices as above):

I think this distributions are reasonably "normal", and one can see how the standard deviation gradually increases. I should add that the algorithm is very fast. See linked thread for the details.

My original answer

A straight-forward modification of your method might do the trick (depending on how close you want the distribution to be to normal). This answer was inspired by @cardinal's comments above and by @psarka's answer to my own question How to generate a large full-rank random correlation matrix with some strong correlations present?

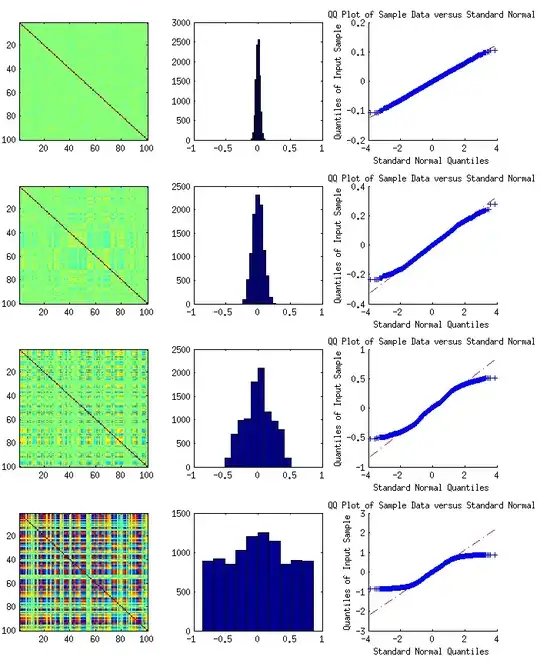

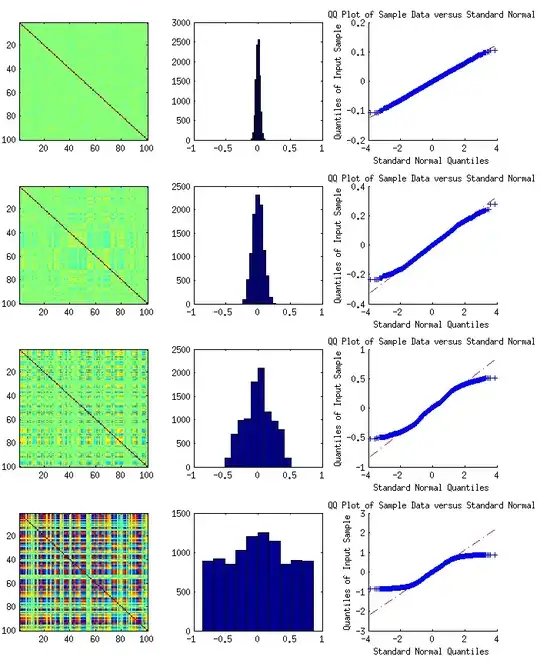

The trick is to make samples of your $\mathbf X$ correlated (not features, but samples). Here is an example: I generate random matrix $\mathbf X$ of $1000 \times 100$ size (all elements from standard normal), and then add a random number from $[-a/2, a/2]$ to each row, for $a=0,1,2,5$. For $a=0$ the correlation matrix $\mathbf X^\top \mathbf X$ (after standardizing the features) will have off-diagonal elements approximately normally distributed with standard deviation $1/\sqrt{1000}$. For $a>0$, I compute correlation matrix without centering the variables (this preserves the inserted correlations), and the standard deviation of the off-diagonal elements grow with $a$ as shown on this figure (rows correspond to $a=0,1,2,5$):

All these matrices are of course positive definite. Here is the matlab code:

offsets = [0 1 2 5];

n = 1000;

p = 100;

rng(42) %// random seed

figure

for offset = 1:length(offsets)

X = randn(n,p);

for i=1:p

X(:,i) = X(:,i) + (rand-0.5) * offsets(offset);

end

C = 1/(n-1)*transpose(X)*X; %// covariance matrix (non-centred!)

%// convert to correlation

d = diag(C);

C = diag(1./sqrt(d))*C*diag(1./sqrt(d));

%// displaying C

subplot(length(offsets),3,(offset-1)*3+1)

imagesc(C, [-1 1])

%// histogram of the off-diagonal elements

subplot(length(offsets),3,(offset-1)*3+2)

offd = C(logical(ones(size(C))-eye(size(C))));

hist(offd)

xlim([-1 1])

%// QQ-plot to check the normality

subplot(length(offsets),3,(offset-1)*3+3)

qqplot(offd)

%// eigenvalues

eigv = eig(C);

display([num2str(min(eigv),2) ' ... ' num2str(max(eigv),2)])

end

The output of this code (minimum and maximum eigenvalues) is:

0.51 ... 1.7

0.44 ... 8.6

0.32 ... 22

0.1 ... 48