Since the fracking industry in the US has started to grow rapidly, I have heard increasing reports that OPEC is attempting some form of predatory dumping in the hopes of making the fracking industry in the US unprofitable.

How successful do economists predict that OPEC's dumping strategy will be? For example, does OPEC have a large profit margin and the fracking industries a small profit margin (making fracking an unprofitable enterprise quite easily under some form of predatory dumping) or are the profit margins close enough to make any predatory dumping infeasible in the short-run?

- 4,128

- 1

- 3

- 16

- 2,778

- 2

- 22

- 44

1 Answers

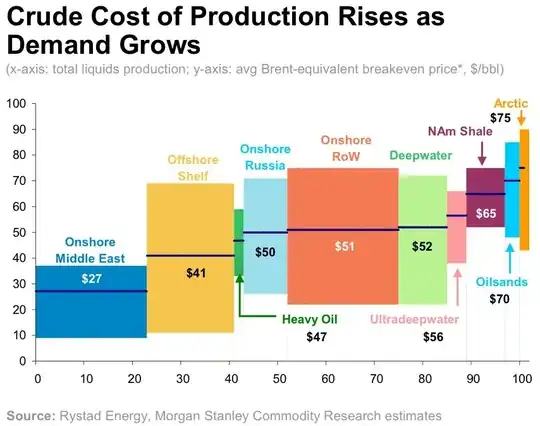

This is the cost curve of oil production (North American shale at $65):

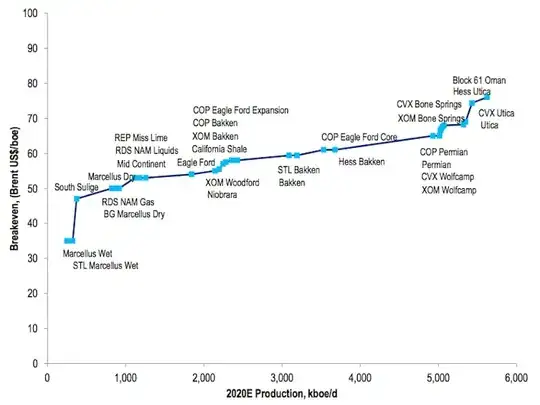

And this is the cost curve of major American projects:

While "Citi's Ed Morse highlighted this chart, showing that for most US shale plays, costs are below $80 a barrel."

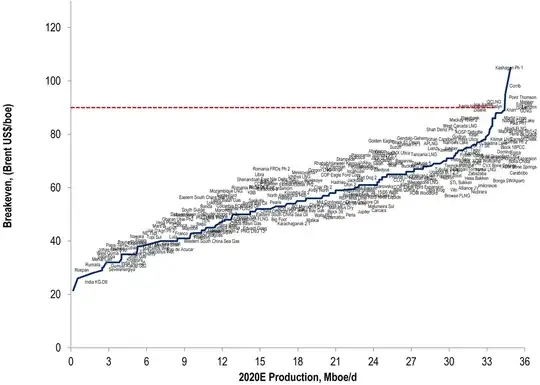

And clearly, many of these new projects would lead to losses with oil prices at $60:

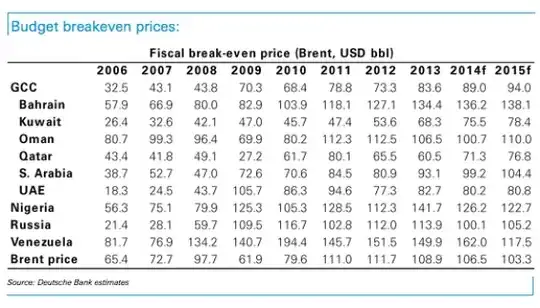

The problem with predatory pricing (if it's purposeful) is that OPEC itself depends on high oil prices to ensure balanced budgets in their (mostly dictatorial) regimes. Their sovereign funds are large enough to survive a brief (2-3 years) period of low oil prices, but in the long run, dumping endangers their rulers' positions:

You can't kill American oil production this way—it would return after these two-three years anyway.

The \$60-80 band leaves space for most American projects, while oil below \$60 kills too many OPEC members. So, it does not seem to be a good dumping strategy.

- 1,577

- 8

- 11

-

"it would return after these two-three years anyway" - [citation needed]. Might be worth thinking about what the risk-reward balance is for the next wave of investors, if the present wave get wiped out. – 410 gone Dec 28 '14 at 03:33

-

And please do separate out short-term and long-term costs. It's not clear from your charts, but AIUI, they are LRAC – 410 gone Dec 28 '14 at 03:39

-

You do mean curve, not curse in the first line right? Too minor for me (as a low rep user here) to edit, but it kind of changes the meaning totally. – Journeyman Geek Dec 28 '14 at 12:32

-

@JourneymanGeek It's "curve." Thanks a lot for noting this. – Anton Tarasenko Dec 28 '14 at 14:51

-

@EnergyNumbers Thanks for comments. Investors in oil production must be aware about OPEC's limited dumping opportunities. Their investments aren't wiped out, but may be delayed. – Anton Tarasenko Dec 28 '14 at 15:30

-

@Anton - it's a question of cashflow - AIUI E&Ps tend to be heavily leveraged, so a year of low prices could be enough to wipe quite a few of them out. That's one reason why short-run marginal costs are at least as relevant as long-run average costs. – 410 gone Dec 28 '14 at 15:40

-

If OPEC increase production to lower prices, wouldn't that lead to higher future prices since the future supply will be lower than without this tactic? This would make it profitable to invest in american oil companies today since one will eventually get returns, securing financial means for the companies in question? /Economic novice – Mårten Jan 16 '15 at 13:07

-

@user1013159 I don't see credible predictions of oil prices, so many American projects may remain unprofitable for a decade or two. Better to spend this time in some other assets. – Anton Tarasenko Jan 16 '15 at 16:06

-

I think while this answer is so far very informative, it only goes part way to answering the question. I would be skeptical us shale projects could survive 2 years at those prices,or would at least present the possibility of investors pulling out and dumping the stock/bonds. Interesting to complete the answer would be info on us shale firms investors and financial health. – Frank May 04 '20 at 05:34